2026 Will Be a Market Surge Year Data + Market Experience

We’re calling it now: 2026 is shaping up to be a breakout year for housing, not because of hype, but because the data, the economy, and consumer psychology are finally lining up.

Not many agents have been in the trenches as long as Sean and Blanca. If you didn’t know, Blanca got licensed in 2006 she built her real estate business through the GFC - the Great Financial Crash of 2007-2012. We’ve been working as a husband and wife team since 2010 - now fast-forward to 2023-2026 we had an interesting few years and people were playing the “waiting game.” We believe that wait if OVER! After years of hesitation, pressure, and uncertainty, families are ready to move forward again. Our role is simple: help them win.

Here’s how we see it.

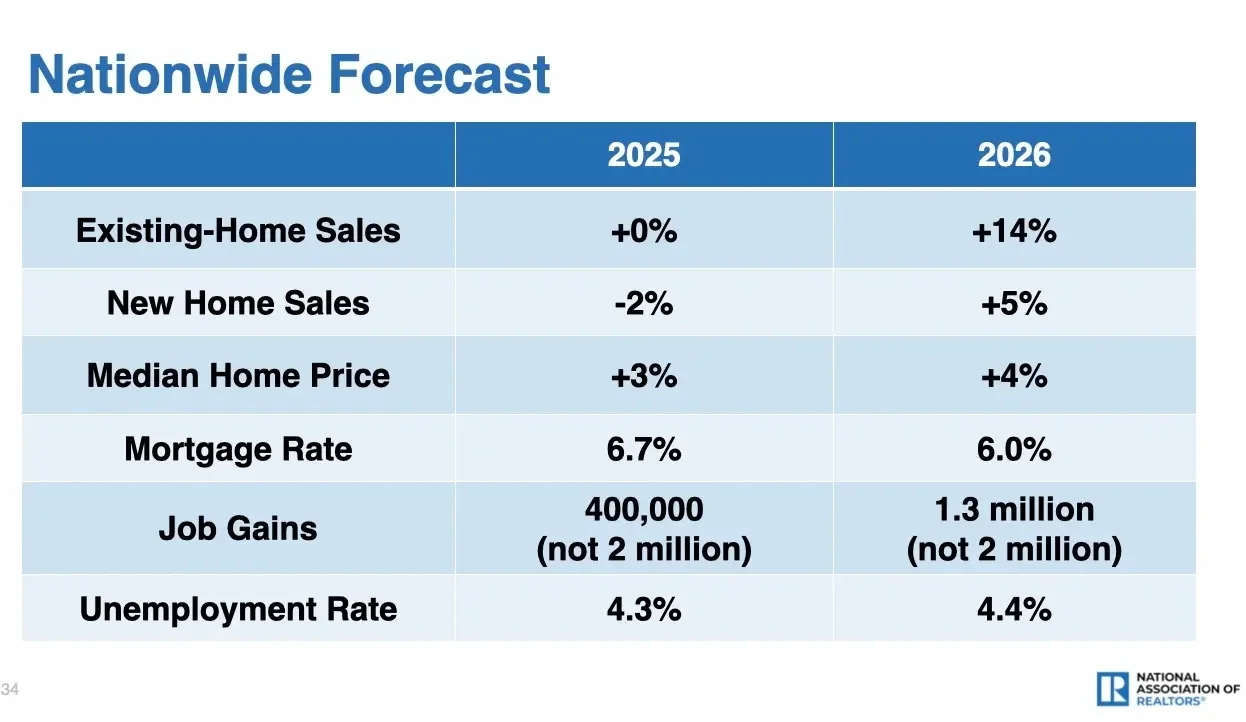

NAR Forecast Signals 14%+ Housing Re-Acceleration

According to economists (NAR Chief Economist Lawrence Yun) presenting on behalf of the National Association of REALTORS®, the housing market is expected to re-accelerate meaningfully in 2026, with projections pointing to roughly a 14% increase in existing-home sales activity nationwide.

That’s a big number, and it matters.

Sales volume doesn’t jump like that unless:

Buyer confidence returns

Financing improves

Pent-up demand is released

All three conditions are now in place. When transactions surge, pricing pressure often follows, especially in strong, desirable markets like North Texas and Minnesota.

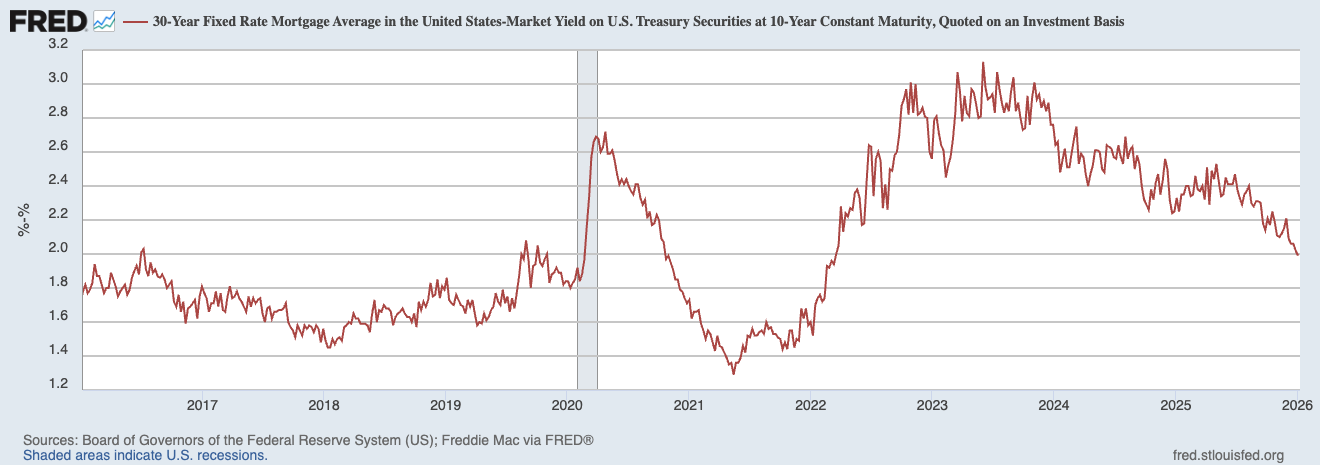

2. Interest Rates Have Shifted From “Paralyzing” to “Manageable”

Mortgage rates in the high-5% to low-6% range have completely changed buyer psychology.

Monthly payments are meaningfully lower than the 7%+ era

More buyers qualify

Sellers are seeing more activity

Deals are actually moving again

Perfection isn’t required, stability is. Rates are now in a zone where families feel comfortable making long-term decisions again.

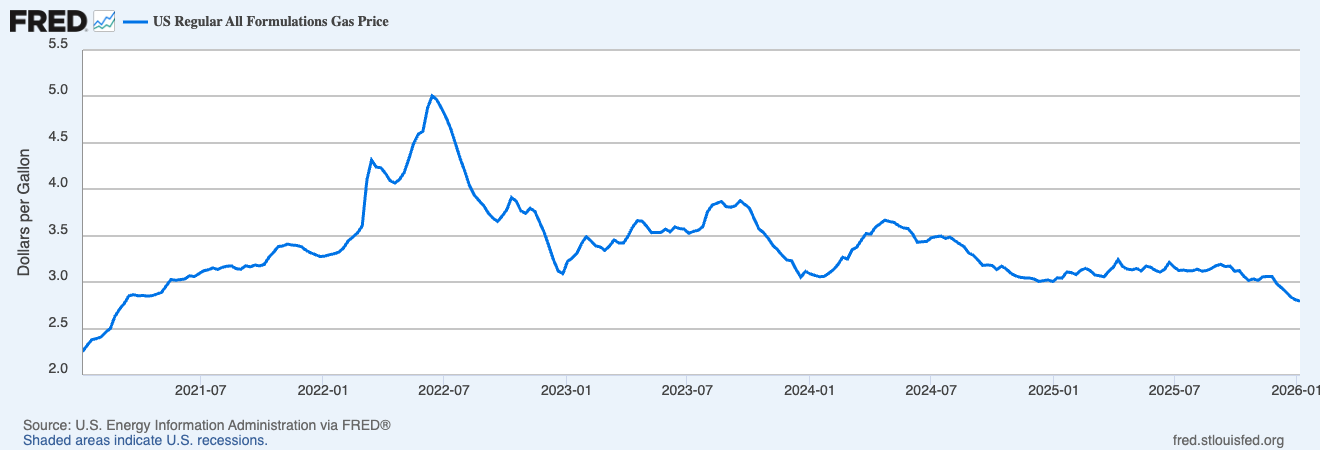

3. Gas Prices Are a Silent Confidence Booster

Nationally, gas prices are averaging around $2.80 per gallon, and in many areas they’re hovering in the low-$2 range, which is excellent by historical standards.

Why this matters:

Lower fuel costs = more disposable income

Families feel less squeezed week-to-week

Consumer confidence improves

With shifting global energy dynamics, there’s a real chance gas prices trend lower, not higher, in 2026, another tailwind for household budgets.

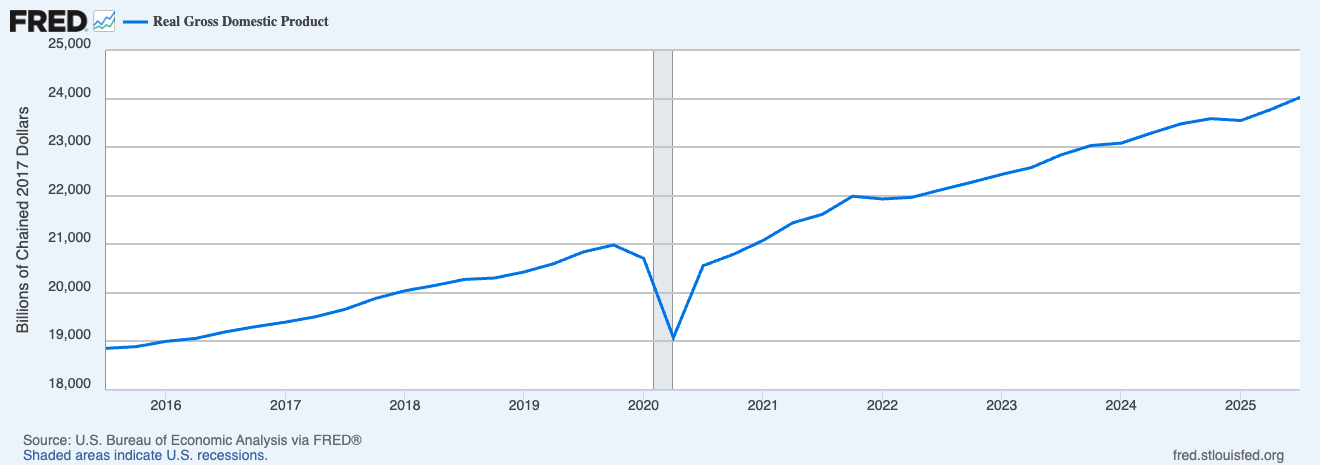

4. The Economy Is Stronger Than the Headlines Admit

Let’s talk facts, not fear.

As of early January 2026, while the final Q4 2025 GDP number hasn’t been officially released, the Atlanta Fed’s GDPNow model projected robust economic growth in the 5.1%–5.4% range.

That’s not weakness.

That’s not stagnation.

That’s economic momentum.

Strong GDP growth supports:

Job stability

Wage growth

Household confidence

Willingness to invest in homes

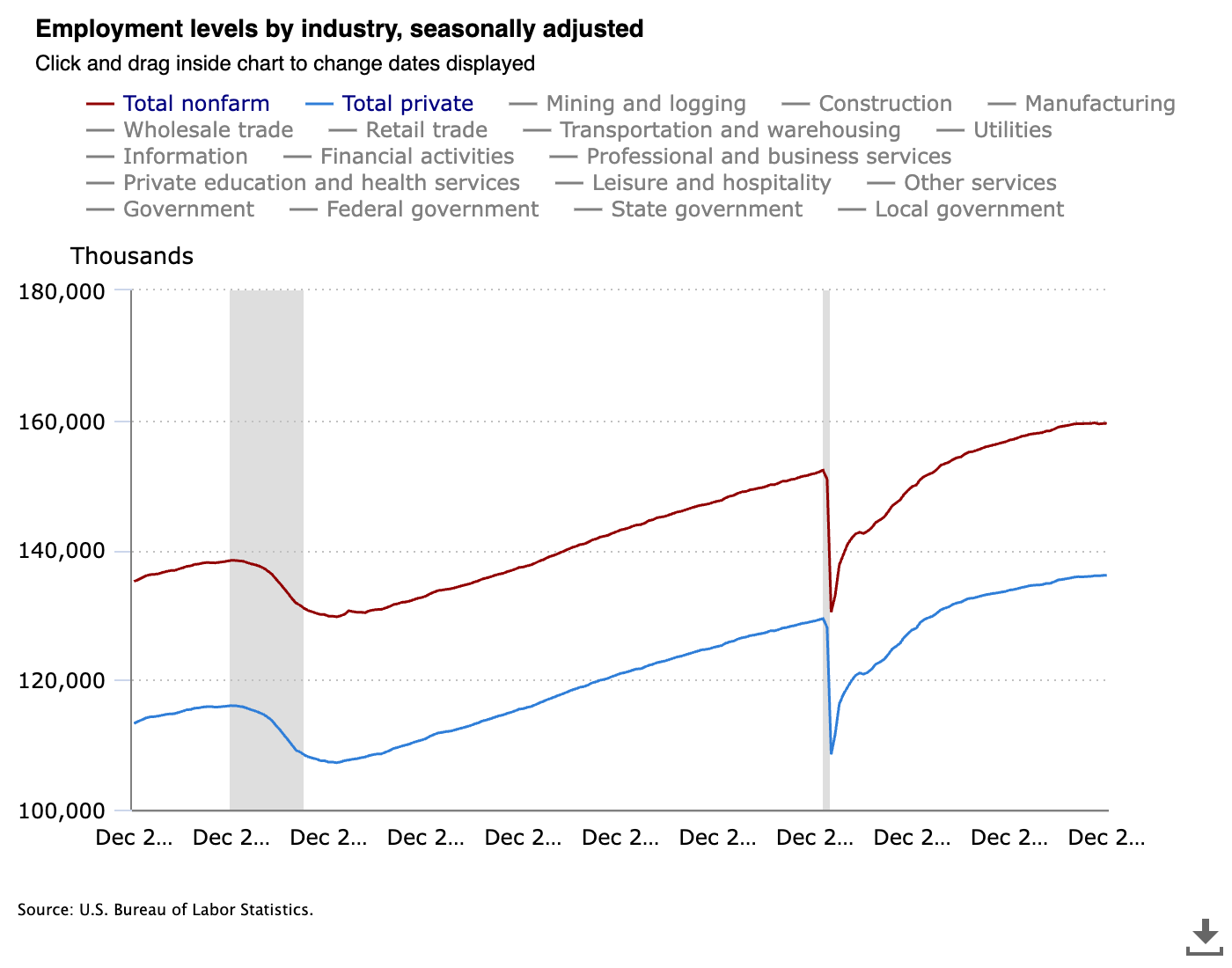

5. Job Market Resilience Is the Silent Backbone

Despite nonstop negative headlines, political and global uncertainty, and emerging AI disruptions that are still unfolding, the U.S. job market has remained remarkably resilient.

People don’t buy homes when they’re scared of layoffs.

They buy when they feel secure enough to plan a future.

50,000 jobs were added in December 2025, slower growth than expected but still positive.

The unemployment rate dipped to ~4.4%, suggesting the labor market is slowing but not collapsing.

That foundation is still intact heading into 2026.

6. Accountability Is Restoring Public Confidence

One of the most under-discussed shifts right now is trust.

The Trump administration has begun investigating and uncovering massive, multi-billion-dollar fraud and abuse across multiple states, practices that many believe were kicked down the road for decades.

For everyday Americans, this matters.

It sends a simple message: someone is finally paying attention.

To give you an idea of how massive the fraud it, Elon Musk has even stated publicly that if fraud and abuse were truly fixed, anyone earning under $500,000 per year could theoretically pay little to no federal income tax.

Whether or not you agree with the exact claim, the psychological impact is real:

People feel heard

People feel protected

People feel optimistic again

And confidence moves markets.

7. Housing Costs Are Becoming More Rational

After years of extreme scarcity pricing, we’re seeing normalization:

Builders are becoming more realistic

Incentives are returning

Sellers are adjusting expectations

This doesn’t weaken housing, it activates it. When buyers feel pricing is fair, activity increases. Volume comes first. Appreciation often follows.

8. Years of “Wait-and-See” Demand Are About to Release

Make it stand out

From 2022 through 2024, millions of families paused:

Inflation was high

Rates were high

Confidence was low

That demand didn’t disappear, it stacked up.

As conditions improve and inventory remains limited, sidelined buyers returning to the market create a powerful dynamic.

9. Even If You’re Not Moving, There Are Smart Plays Right Now

Even if you’re staying put in 2026, this is still a year to plan.

Sean & Blanca have partnered with a wholesale lender offering some of the lowest rates available. If you:

Bought when rates were in the 7% range

Want to refinance

Want to consolidate debt

Or want to explore smart investment strategies

👉 Get started here:

https://bit.ly/ourlender

No pressure. Just options.

10. Our Call for 2026

We believe 2026 will be remembered as:

The year confidence returned

The year buyers re-entered

The year smart families made decisive moves

Not chaos.

Not collapse.

A calculated surge.

And our mission is simple:

To help families make smart, strategic decisions, so they don’t just participate in 2026… they win in it.